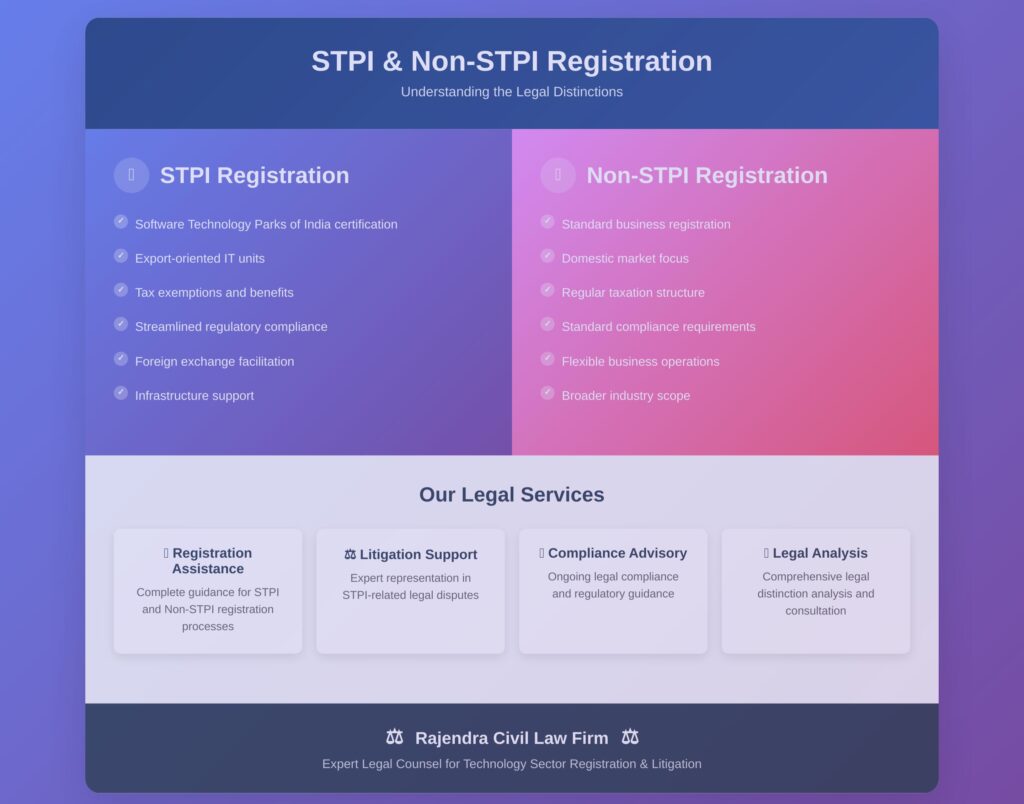

At Rajendra Civil Law Firm, we specialize in corporate legal services, including STPI (Software Technology Parks of India) and Non-STPI registrations, compliance, and litigation. Understanding the differences between these two frameworks is crucial for businesses in the IT/ITES sector. This article explores the legal distinctions, registration processes, benefits, and common litigation issues related to STPI and Non-STPI entities.

What is STPI and Non-STPI Registration?

STPI Registration Explained

The Software Technology Parks of India (STPI) is an autonomous society under the Ministry of Electronics and Information Technology (MeitY). It provides tax incentives, infrastructure support, and export facilitation for IT/ITES companies.

Key Features of STPI Registration:

- 100% Foreign Direct Investment (FDI) allowed under the automatic route.

- Tax exemptions under Section 10A/10B of the Income Tax Act (though phased out, some benefits remain).

- Simplified compliance for software exports.

- Single-window clearance for approvals.

Businesses opting for STPI registration must operate within designated STPI zones and comply with export obligations.

Non-STPI Registration Explained

Non-STPI companies operate outside STPI’s purview and are governed by standard corporate laws. These firms do not enjoy STPI-specific incentives but have greater operational flexibility.

Key Aspects of Non-STPI Entities:

- Subject to standard taxation (GST, corporate tax).

- No export obligations unless engaged in international trade.

- Must comply with general corporate and labor laws.

Choosing between STPI and Non-STPI registration depends on a company’s business model, tax planning, and long-term goals.

Legal Distinctions Between STPI and Non-STPI Entities

Compliance Requirements

STPI-Registered Companies Must:

- Submit annual performance reports to STPI authorities.

- Maintain separate export earnings accounts.

- Follow FEMA (Foreign Exchange Management Act) guidelines for foreign transactions.

Non-STPI Companies Must:

- Adhere to standard corporate compliance (MCA filings, GST returns).

- Follow labor laws (PF, ESI, Shops & Establishment Act).

- Comply with international trade laws if exporting.

Tax Implications

| Aspect | STPI | Non-STPI |

|---|---|---|

| Income Tax | Exemptions (if eligible) | Standard corporate tax |

| GST | Applicable | Applicable |

| Customs Duty | Benefits on imports | Standard rates |

Litigation Risks

Common Legal Disputes for STPI Companies:

- Breach of export obligations leading to penalties.

- FEMA non-compliance in foreign transactions.

- IP disputes in software licensing.

Non-STPI Litigation Risks:

- Contractual disputes with vendors or clients.

- Tax litigation over GST or income tax filings.

- Employment-related lawsuits.

Why Choose Rajendra Civil Law Firm for STPI & Non-STPI Matters?

At Rajendra Civil Law Firm, we provide:

✅ End-to-end registration assistance for STPI & Non-STPI entities.

✅ Compliance audits to prevent legal risks.

✅ Litigation support for disputes.

✅ Tax advisory services for optimal structuring.

FAQs on STPI & Non-STPI Registration

STPI offers tax incentives and export benefits for IT/ITES companies

Yes, but it requires fresh registration and approval from STPI

Fines, revocation of benefits, and legal action may apply

Yes, under FEMA regulations for foreign investments

We handle disputes, compliance audits, and represent clients legally

Conclusion

Choosing between STPI and Non-STPI registration impacts taxation, compliance, and litigation risks. Rajendra Civil Law Firm offers expert legal guidance to ensure seamless registration and dispute resolution. Contact us today for tailored corporate legal solutions!

Read More

- Efficient Property Registration Services to Secure Your Ownership

- Income Tax Litigation: Strategies for Success

- Income Tax Appellate Tribunal: Your Key to Resolving Tax Disputes

- Efficient Company Registration Services for Your Business | Register Now

- Foreign Direct Investment (FDI): Legal advice and Support

- Expert Legal Counsel for Mortgage-related Matters